when are property taxes due in williamson county illinois

Williamson County IL property tax assessments. Williamson County collects on average 138 of a propertys assessed fair market value as property tax.

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Call the Williamson County Clerk at 618-998-2110 and ask for an Estimate of Redemption.

. Property assessments performed by the Assessor are used to determine the Williamson County property taxes owed by individual taxpayers. March 7 Sent off final abstract. If the tax bills are mailed late after May 1 the first installment is due 30 days after the date on your tax bill.

2021 property taxes must be paid in full on or before Monday January 31 2022 to avoid penalty and interest. A 1000 cost will be added for. The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000.

Mail received after the due date and without a valid postmark cannot be accepted as proof of on-time payment. Welcome to Property Taxes and Fees. Residents wanting information about anything related to property taxes or fees paid to the county can click through the links in this section.

September 13 September 25 400 pm. July 11 1st Installment Due. 3 penalty on 1st Installment 15 penalty on 2nd Installment.

When are property taxes due in williamson county illinois Saturday February 26 2022 Edit Levied annually property taxes are calculated by multiplying the assessed value of the property by the effective tax rate applicable in the propertys region also referred to as an ad valorem tax as well as taking into account any exemptions or deductions. Please call the assessors office in Marion before you send documents or if you need to schedule a meeting. Tax amount varies by county.

138 of home value. A USPS postmark date of 22822 will be accepted as proof of timely payment. Due dates will be as follows.

Property owners who have their taxes escrowed by their lender may view their billing information using our Search My Property program. If you have general questions you can call the. Taxes 2022 Williamson TN 2022 Williamson TN.

The phone number should be listed in your local phone book under Government County Assessors Office or by searching online. July 12 Sept 1215 Penalty on 1st Installment. The median property tax in Williamson County Illinois is 1213 per year for a home worth the median value of 87600.

THE APPLICATION DEADLINE FOR 2021 is April 5 th 2022. Remember to have your propertys Tax ID Number or Parcel Number available when you call. Banks cannot collect delinquent tax.

This exemption must be renewed annually. 2021 Williamson County property taxes are due by February 28 2022. 2018 - 2019 Real Estate Tax Collection Schedule.

Please remember that the county is not selling the property at the sale but rather the unpaid. Real estate tax bills will be mailed beginning on May 1 and the first installment payment will be due June 3. Property tax rates and tax roll.

First-time applicants can obtain forms from the County Assessors Office. According to Illinois State Statute the County Treasurer must hold an annual tax sale to sell unpaid property taxes. 173 of home value.

2021 Property tax statements will be mailed the week of October 18th. May 28 Mail Tax Bills. All 102 counties in Illinois are considered disaster areas by both the state and federal governments because of COVID-19.

2 nd Installment due September 1 2022 with the interest to begin accruing September 2 2022 at 15 per month post-mark accepted. Interest is added at the rate of 1-12 per month for delinquent taxes or any fraction thereof after penalty dates until tax is sold or forfeited. Williamson County collects relatively high property taxes and is ranked in the top half of all counties.

Clicking on the links with this symbol will take you to a county office or related office with its own website while the links without the symbol belongs to a. Illinois is ranked 1156th of the 3143 counties in the United States in order of the. Currently in Illinois properties are assessed at 13 or 33 of their market value with the exception of Cook CountyAlso an equalization factor or.

In most counties property taxes are paid in two installments usually June 1 and September 1. Property tax appeals and reassessments. Illinois homeowners again paid the nations second-highest property.

Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. This exemption freezes the assessment on your property if your total household income is 6500000 or less. This exemption does not freeze your tax rate.

Important message regarding the taxes paid to Claypool Drainage District. Paying property tax bills and due dates. It freezes the assessed valuation that appears on your tax bill.

1 st Installment due June 1 2022 with the interest to begin accruing June 2 2022 at 15 per month post-mark accepted. Brophy is encouraging all residents to use one of the alternate methods to pay taxes rather than come to the office and waiting in often long lines. M-F 800am - 400pm.

The median property tax also known as real estate tax in Williamson County is 121300 per year based on a median home value of 8760000 and a median effective property tax rate of 138 of property value. Yearly median tax in Williamson County. Failure to receive a tax bill will not relieve the tax payer of penalties accruing if taxes are not paid before the penalty date.

Make sure you have your parcel number. May 3 Co Clerk Extends Taxes. 407 N Monroe Marion IL 62959 Phone.

September 12 2nd Installment Due. Assessed value is the foundation upon which taxing authorities determine the amount of real estate taxes to be paid. 2021 Property Tax Information.

You can call the Williamson County Tax Assessors Office for assistance at 618-997-1301-Ext142.

Williamson County Illinois Home County Seat Of Williamson County

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Cook County Il Property Tax Search And Records Propertyshark

59 Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l Buy A Farm Land And Auction Company

Williamson County Il Property Tax Search And Records Propertyshark

Circuit Clerk Williamson County Illinois

History Williamson County Illinois

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Williamson County Illinois Home County Seat Of Williamson County

59 Acres Williamson County Il Farmland Farm Tillable Barn Timber 2400l Buy A Farm Land And Auction Company

Williamson County Illinois Home County Seat Of Williamson County

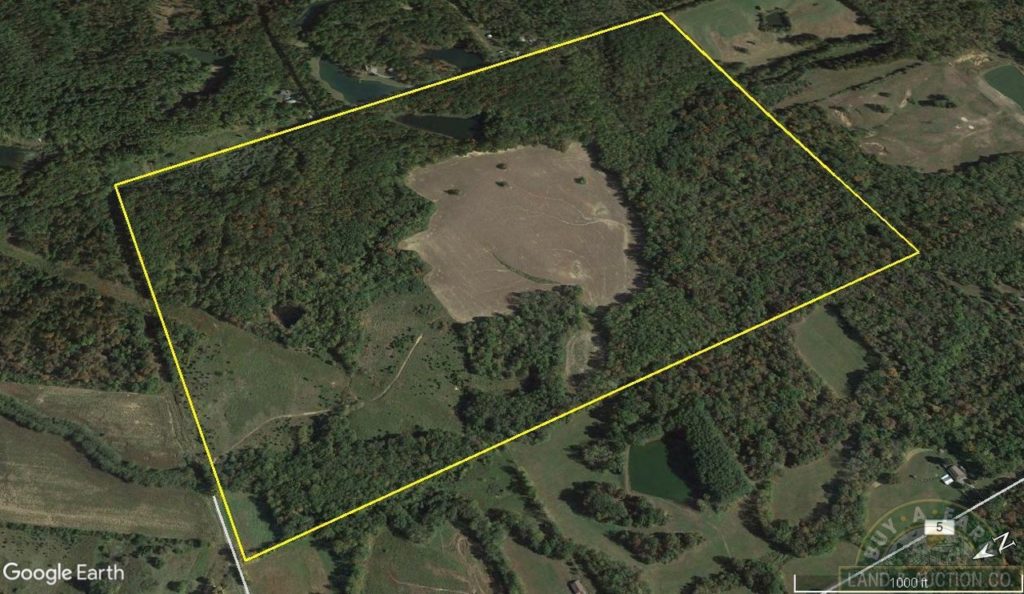

For Sale 240 Acres Williamson County Il Hunting Recreation Wooded Tillable Ponds 2292l Buy A Farm Land And Auction Company

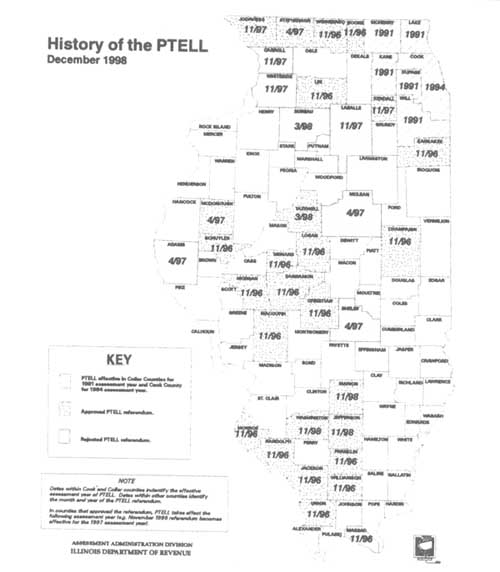

Surviving Property Tax Caps In Illinois Public Libraries

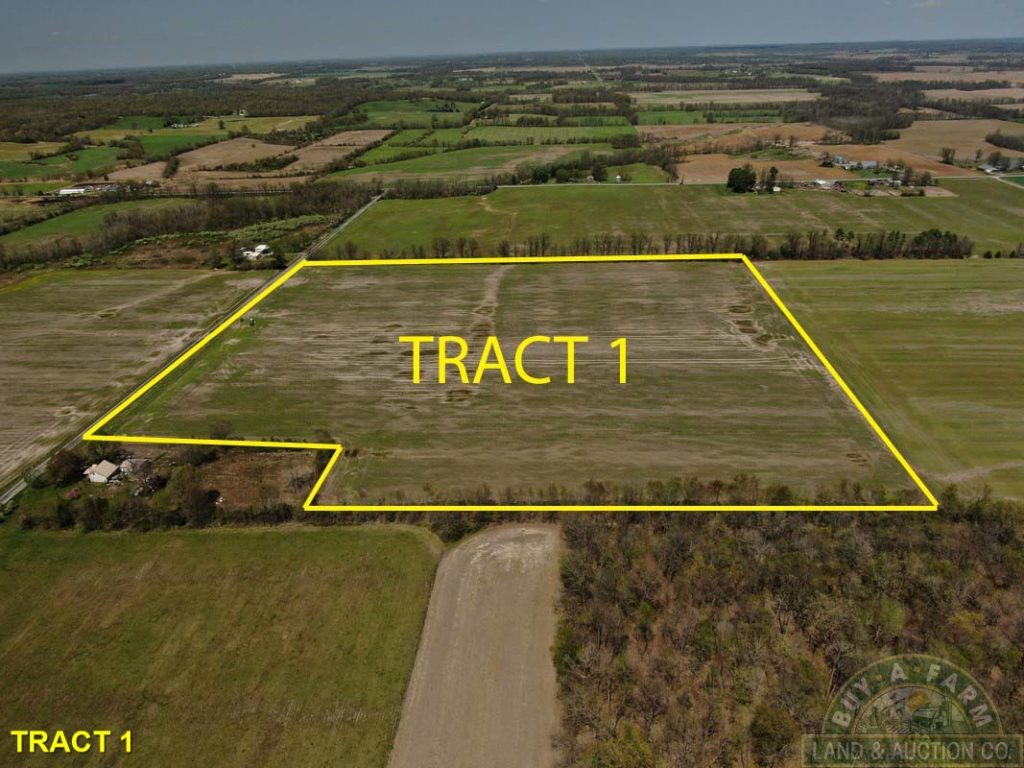

Online Land Auction Williamson And Saline County Il 135 Acres Well Maintained Farmland 4 Tracts 2766a Buy A Farm Land And Auction Company

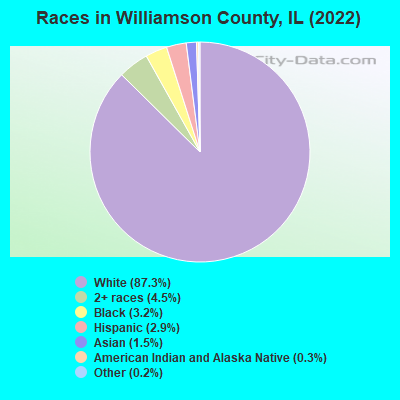

Williamson County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More